colorado estate tax threshold

Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. No estate tax or inheritance tax Connecticut.

10 Tax Deductions For Seniors You Might Not Know About

Federal taxable income serves as the base for Colorado income tax.

. Subtracting the exemption of 1206 million leaves a taxable estate of 582 million. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF. January 1 2021 through December 31 2021.

Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. The taxpayer was a full-year resident for the preceding tax year which consisted of 12 months and the taxpayer had no net Colorado tax liability for that tax year. The department will consider among other things.

Consulting the chart youll see that your estate is in the highest bracket. Nonresident real estate withholding DR 1079. Apportionment percentage The apportionment percentage used to calculate a part-year resident or nonresidents Colorado income tax is based on the taxpayers federal adjusted gross income modified by any additions.

April 1 2016 through March 31 2017. If the asset value exceeds the exemption amount there can be a significant estate tax at rates between 35 and 55. To calculate the Colorado income tax a flat tax rate of 455 percent is applied to federal taxable income after.

You also pay 40 on the remaining 482 million which comes to 1928 million. To qualify for a small estate probate in Colorado the estate must not contain any real property ie. A taxpayers Colorado income tax liability is calculated as follows.

But if its the decedent who has children from a past relationship the spouses share drops to the estates first 150000 and half the balance according to. A Colorado resident is a person who has made a home in Colorado or a person whose intention is to be a Colorado resident. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return.

You are required to file a federal income tax return or. The Estate Tax is a tax on your right to transfer property at your death. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Land homes buildings etc and the decedents personal property must be less than 74000 As of 2022. The Colorado income tax rate for tax years 2018 and prior was 463 for tax year 2019 was 45 and for tax year 2020 is 455. April 1 2017 through December 31 2018.

For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million. In general a C corporation must remit Colorado estimated tax payments if its net Colorado tax liability for the tax year exceeds 5000. With a small estate probate assets can simply be collected by obtaining what is called a small estate.

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1 assessment date. The estate tax is a tax on an individuals right to transfer property upon your death. Part-year residents will initially determine their Colorado taxable income as though they are full-year residents.

A federal estate tax return can be. For this the first 225000 of the decedents estate goes to the spouse as well as half of the balance. A part-year resident of Colorado will complete the Colorado Individual Income Tax Return DR 0104 and the Part-Year Resident Tax Calculation Schedule DR 0104PN to determine what income will be claimed on the DR0104 form.

And to find the amount due the fair market values of all the decedents assets as of death are added up. 1 Any funds after that will be taxed as they pass. EITC is available for lower-income households currently the limits are about 21000 for a single filer or 54000 for a family with two children.

Retail Sales for rules for determining the location of a sale. Fisher Investments has 40 years of helping thousands of investors and their families. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

January 1 2020 through December 31 2020. A nonresident of Colorado with Colorado source income AND. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value.

The answer is undoubtedly because it is cheaper and quicker. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. All retail sales are considered for the purpose of the 100000 threshold regardless of whether those sales would be subject to Colorado tax.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. Your base tax payment on the first 1 million is 345800. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

This Part 8 discusses the calculation of required quarterly estimated payments the remittance of estimated payments and the estimated tax penalty imposed for failure to remit required estimated payments. January 1 2019 through December 31 2019. The taxpayers net Colorado tax liability minus all credits withholding and any sales tax refund is less than 1000.

The state currently provides a. You have a Colorado income tax liability for the year. Policy that changes federal taxable income will also change Colorado taxable income.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income.

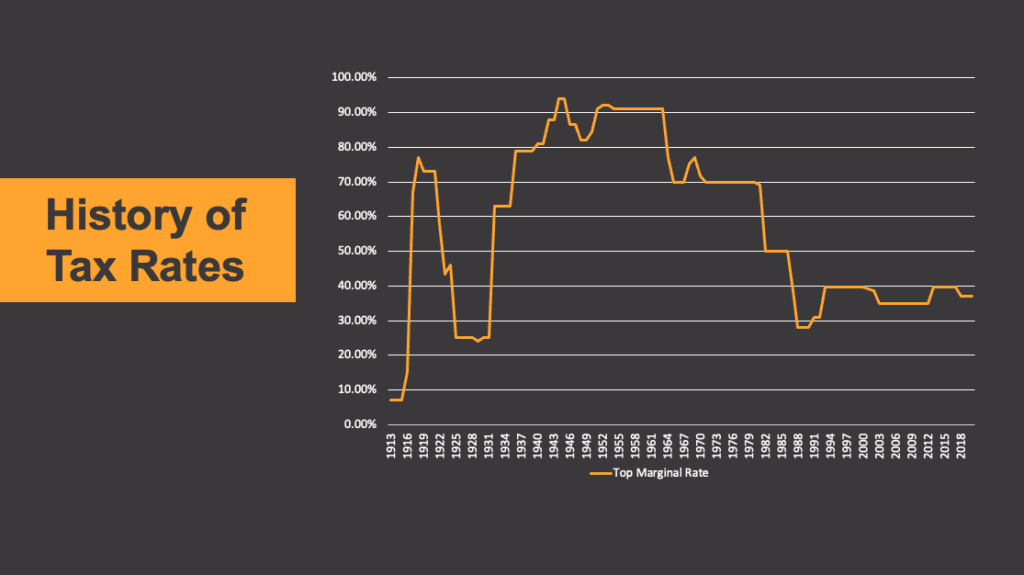

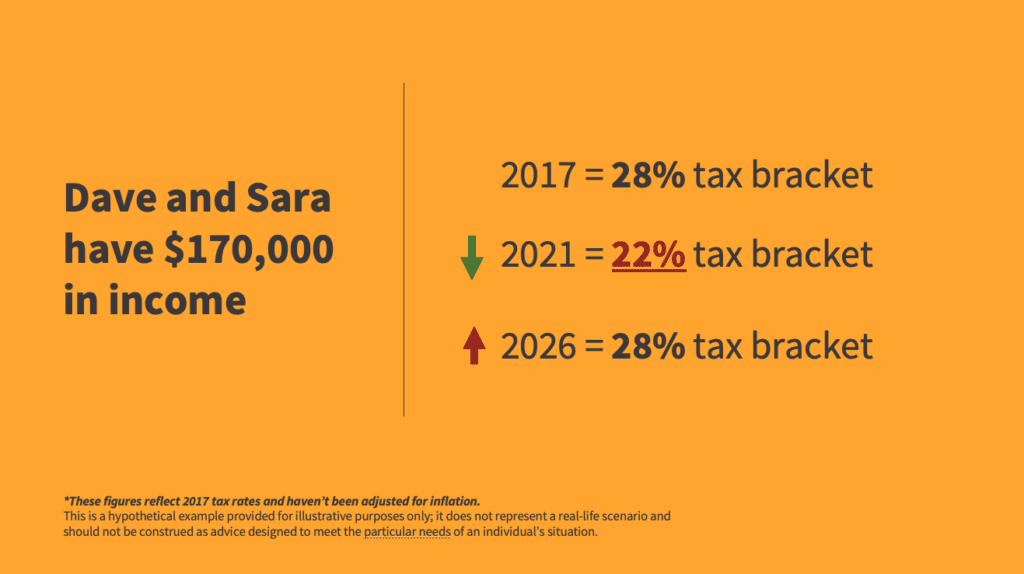

Tax Planning In 2021 Avoiding Potential Tax Storms

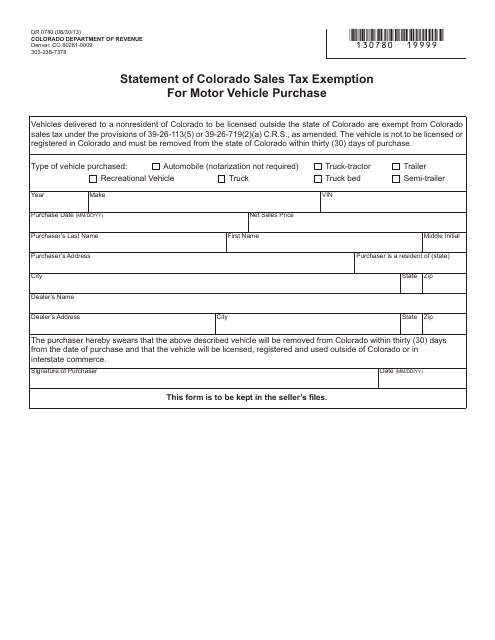

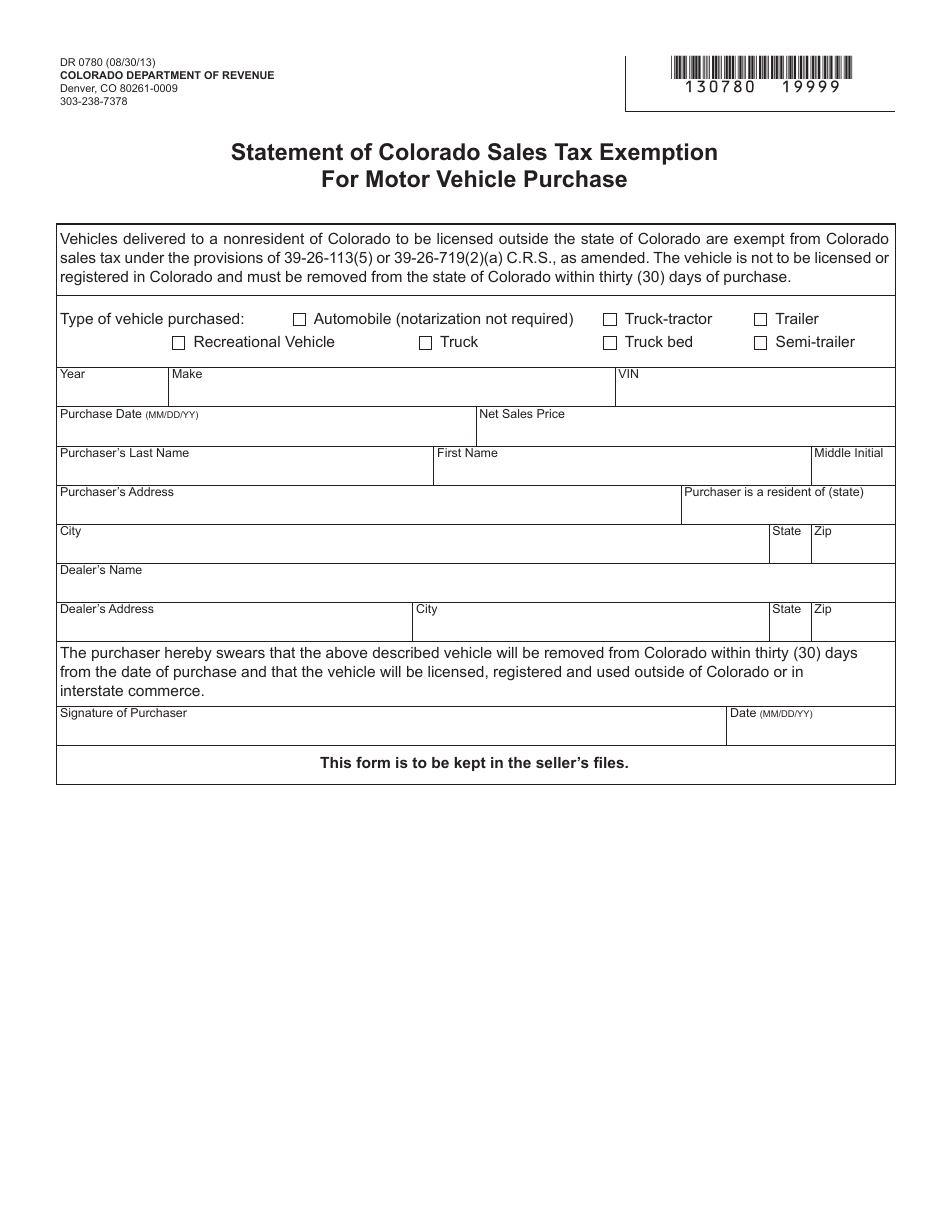

Form Dr0780 Download Fillable Pdf Or Fill Online Statement Of Colorado Sales Tax Exemption For Motor Vehicle Purchase Colorado Templateroller

Tax Planning In 2021 Avoiding Potential Tax Storms

Fiduciary Income Tax Department Of Revenue Taxation

Tax Planning In 2021 Avoiding Potential Tax Storms

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Fiduciary Income Tax Department Of Revenue Taxation

Form Dr0780 Download Fillable Pdf Or Fill Online Statement Of Colorado Sales Tax Exemption For Motor Vehicle Purchase Colorado Templateroller

Estate Tax Definition Tax Rates And Who Pays Nerdwallet

New Clawback Proposed Regulations What You Need To Know Interactive Legal

Form Dr0780 Download Fillable Pdf Or Fill Online Statement Of Colorado Sales Tax Exemption For Motor Vehicle Purchase Colorado Templateroller

Case Study Multi State Planning Opportunity

How Is My Trust Taxed In Colorado Brestel Bucar

Tax Planning Anzen Legal Group

How Is My Trust Taxed In Colorado Brestel Bucar